Situation at the Start of the Project

Longan Group is one of Asia’s leading debt management firms, specializing in acquiring non-performing loans (NPLs) from banks and financial institutions. By helping these institutions offload balance sheet liabilities, Longan contributes to a more stable and healthier credit market.

Focusing on Vietnam, Longan employs a multi-pronged collection strategy, combining ethical soft collection methods with legal collection – a pioneering approach in the market for unsecured portfolios. Legal collection is particularly effective for older portfolios with high days-past-due (DPD), ensuring maximum recovery where traditional methods fall short.

Initially, Longan managed its legal collection processes manually, relying on exported CRM data. This method hindered operational efficiency, creating bottlenecks before scaling efforts.

Task

After manually managing workflows through exported CRM data, the company recognized the need for a technology-driven solution to overcome operational bottlenecks.

Vendor Selection & Key Criteria

To ensure a successful transition, Longan evaluated multiple systems based on:

- Vendor expertise in large-scale process implementation.

- Out-of-the-box functionality, minimizing customization needs.

- Platform flexibility to adapt to Vietnam’s legal and regulatory requirements.

After a thorough assessment, RunRule Solutions was selected as the preferred partner due to its advanced technological capabilities and alignment with Longan’s objectives.

Pilot Implementation & Objectives

The Country Manager set an ambitious two-month timeline to launch a pilot Debt Collection solution, focusing on:

- Processing speed – Measuring efficiency gains in case handling.

- Execution quality – Ensuring accuracy and compliance in legal workflows.

- Scalability – Validating the system’s ability to support business growth.

The pilot’s success would determine Longan’s future investment in digital transformation, including budget allocation for full-scale deployment.

Solution

The RunRule Solutions team proposed an out-of-the-box Debt Collection solution based on the 2RS Platform. The key reasons for selecting this developer were:

- The company’s strong market reputation and relevant expertise.

- Proven experience in managing large-scale processes (e.g., processing 10,000 documents simultaneously, assigning statuses to 1,000 clients at once).

- No need for additional modifications from either the client or the vendor.

- Flexible process customization without code changes.

A total of five people participated in the project. From Longan Group: a business analyst, a data analyst, and the head of legal collection. From RunRule Solutions: a project manager and a business analyst.

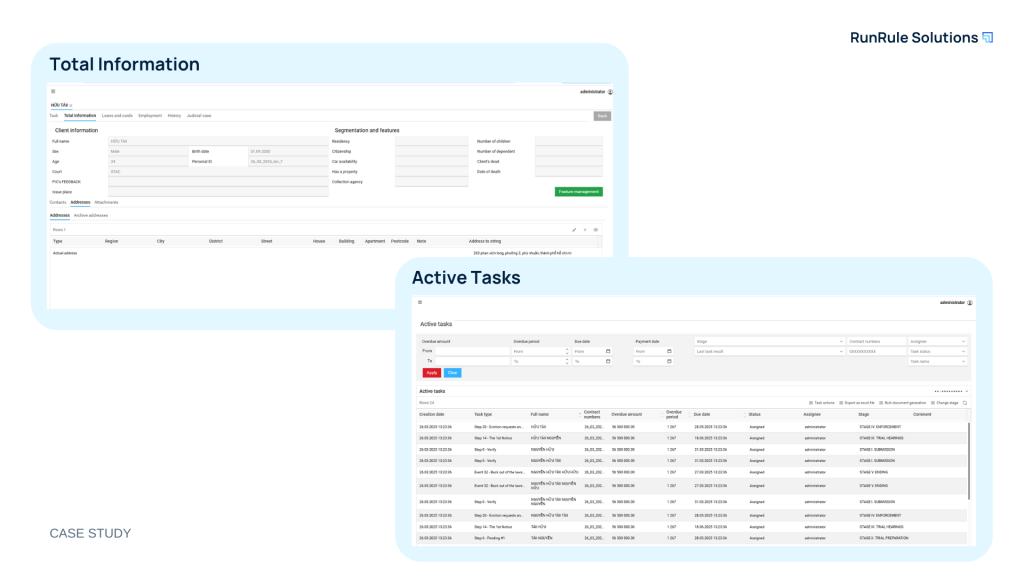

The vendor implemented the following improvements:

- Adaptation of the data import mechanism and contract classification.

- Customization of interfaces based on business specifics.

- Localization of the user interface.

- Development of document templates according to client requirements.

- Implementation of a batch document printing mechanism.

Project Results

The project was completed on time — within 2 months. During the pilot launch:

- 600 client cases were successfully processed.

- The risk of human errors and financial losses was reduced.

- The debt collection portfolio was expanded.

- The system was adapted to local requirements.

Automating legal collection was a complex task, as it involved a significant amount of manual work, including court visits, document submissions, and deadline monitoring. While full automation was not feasible, the system significantly streamlined key processes.

The client highly appreciated the delivered product and the RunRule Solutions team, acknowledging their efficient work on the technical requirements, the speed, and quality of the implementation. The client also explored the 2RS Platform and began making necessary adjustments independently. Moreover, during the collaboration, Longan Group’s analyst mastered the platform’s tools and is now capable of handling tasks without additional support.

Longan Group plans to:

- Scale the solution to process thousands of cases every month

- Accelerate the collection process by 20% and increase recovery rates.

- Expand the application’s use to other Asian markets.

- Maintain the system independently by transferring expertise in-house.

Thus, the implementation of the Debt Collection solution not only aided in the partial automation of legal collection for Longan Group but also laid the foundation for more efficient business operation.