10+

years of fintech automation expertise

6regions

are covered by our best ideas & practices

200+

projects were completed by our experts

We deliver custom solutions for unique challenges in:

- Loan Origination

- Debt Collection

- Risk Optimization

- Marketing

carry out tasks for both business and IT departments with equal quality

guarantee the ability to quickly independently make changes to the system

ensure a high level of service - our systems are genuinely user-friendly

help achieve target KPIs – TimeToYes / TimeToCash / Approval rate etc. – and reduce costs associated with executing business processes

have extensive experience in developing automated banking systems

implement systems quickly and at an affordable cost

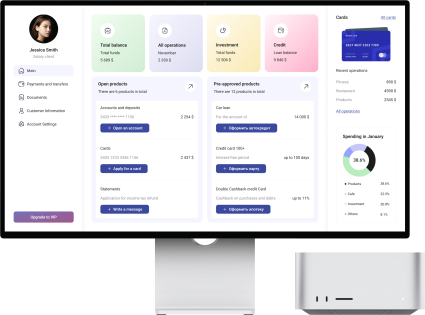

Use a unified banking app ecosystem for seamless business process automation and achieving key KPIs:

Loan origination

Automate any target processes within 3 months, enabling businesses to improve the quality of their credit portfolio, assess client reliability effectively, and reduce delinquency rates.

Factoring

The system allows creating and storage of all counterparty data in a single syste

2RS Platform

All decisions are based on a convenient framework that allows reducing time to market, budgets for business product development and employee expenses.

Decision support system

An automated tool that boosts business productivity by processing tens or hundreds of thousands of applications, reducing «Time to YES» without adding staff.

Campaign Manager

Transitioning the business from operational to strategic planning to enhance customer service and increase sales.

Debt collection

Effective debt recovery at all stages from Pre to Legal, increasing recovery rates by 40% and improving departmental efficiency by 50%.

What is the functionality?

сreate a data model

configure business processes

construct the necessary form

add required business rule

integrate necessary systems

test and refine the solution as needed