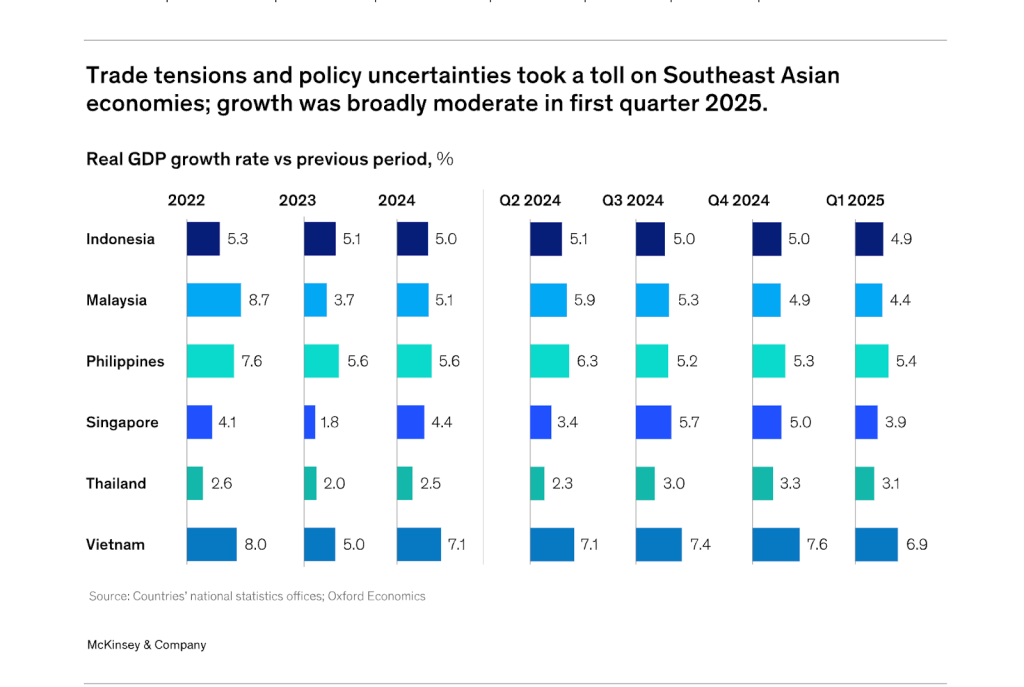

Over the past two decades, Vietnam has undergone an impressive transformation from one of Asia’s developing countries to a dynamically strengthening economy with lower-middle-income status. The average annual GDP per capita growth has exceeded 7%, and in 2025, despite external challenges, the country’s economy grew by 6.93% in the first quarter.

Thanks to its strategic location, low-cost labor force, and smart policies for attracting foreign investment, Vietnam has become a critical link in global supply chains. Manufacturing now accounts for over 20% of GDP, with electronics leading the country’s export volume.

The government has set an ambitious target of 8% economic growth for 2025, banking on digitalization, fintech development, and export resilience. To support this vision, the government has introduced a set of forward-looking initiatives aimed at accelerating business growth by next year. They are strongly connected with national digital transformation strategy and business-friendly investment policies.

However, risks remain – high inflation, the dong’s exchange rate volatility, and the need for balanced monetary policy all demand close attention.

Banking Sector: Full Speed Toward Digitization

Improving bank credit fundamentals from stronger domestic business activities and government supportive measures

Vietnam’s banking sector is undergoing an accelerated digital shift. From mobile banking to AI-powered services, financial institutions are investing in technology to improve customer experience and boost operational efficiency.

Supported by expanding 5G infrastructure and strong fintech partnerships, banks are extending their reach to underserved populations, especially in rural areas. This aligns with Vietnam’s national financial inclusion strategy, which targets 80 % adult account ownership by 2025.

According to The Investor, in 2025, bank credit growth reached 6.2 % year-over-year, while non-performing loans (NPLs) remained below 2 %, indicating a healthy and stable system.

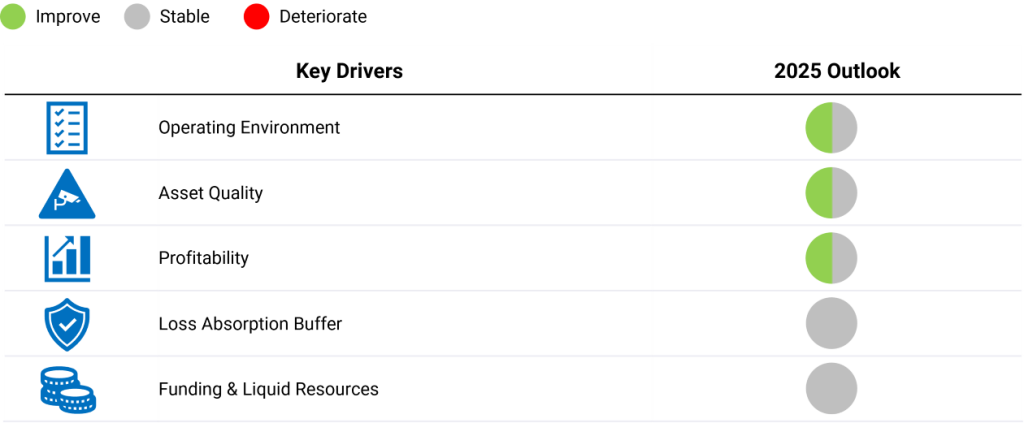

Credit Outlook 2025: Signs of Measured Recovery

According to VIS Rating, Vietnam’s credit fundamentals are set to improve modestly in 2025. The key factor becomes the government policies which are directed to keep the economic stability and address industry constraints.

What is more, it is anticipated that borrowers will experience an improvement in their cash flow and debt repayment capacity throughout this year. It is caused by increased government spending, a steady influx of foreign direct investment, a trade surplus, and the government’s ongoing efforts to address legal matters.

Fintech: A Core Engine of Digital Growth

Vietnam’s fintech sector is among the fastest-growing in Southeast Asia, with its market size reaching $16.9 billion in 2024. According to the experts, it is projected to expand to $62.7 billion by 2033, reflecting a 14.2% CAGR.

Key growth drivers include:

- 84 % smartphone penetration

- the government’s push toward a cashless society

- rapid integration of AI and blockchain technologies

- rising domestic–foreign partnerships

- strategic support for digital inclusion initiatives.

The number of fintech firms surged from just 39 in 2015 to over 260 in 2023, demonstrating resilience despite global funding challenges. The sector remains pivotal to Vietnam’s digital transformation, with digital lending expected to grow by 51% and digital insurance by 28% by 2025. Notably, 35 million new eKYC-based accounts were opened in 2023 alone — a strong sign of consumer readiness and digital infrastructure maturity.

Risks, and Strategic Outlook for Vietnam’s Banking & Fintech Sectors

The banking and fintech landscape is undergoing a transformative shift, with several critical developments taking center stage: AI-integration and big data, growth of digital payments and multi-wallets, flexible consumer lending, regulatory technology (RegTech), expanding financial inclusion, cybersecurity, digital ecosystems creation, and blockchain solutions introduction. The main directions on banking and fintech innovations will be:

- Digital transformation

Vietnam’s financial sector has undergone remarkable digital transformation, with 95% of banking transactions now processed digitally and 87% of adults holding financial accounts. Major banks are aggressively expanding mobile banking, e-wallets, and online services while partnering with fintech firms to drive innovation and expand financial inclusion.

Leading banks are leveraging AI and big data to personalize services, streamline operations, and strengthen risk management, with multi-service digital platforms becoming central to customer strategies.

- Retail and corporate lending

Retail lending growth is expected to accelerate from 12% in 2024 to 15% in 2025, with overall lending growth of about 15%. What is more, special attention is paid to long-term lending to infrastructure projects and real estate, which supports the growth of net interest margin (NIM).

Nevertheless, the financial sector also faces new challenges and risks:

- Non-performing loans (NPL) growth

Rising NPLs reflect asset quality pressures which lead to economic difficulties and problems in the real estate sector.

- Competition with fintech

Fintech disruptors are forcing traditional banks to adapt faster, accelerating digitalization and enhancing customer service.

- Uneven recovery

Large state-owned and private banks are performing better, while small and medium-sized banks face challenges due to competition, high deposit costs, and issues with asset quality.

Conclusion

Vietnam’s economy—particularly its financial sector—is going through significant and serious changes, creating a more efficient, inclusive, and secure banking environment. With continued investment in artificial intelligence, data infrastructure, and digital ecosystems, the country is not only increasing access to financial services but also laying the groundwork for long-term economic resilience.

RunRule Solutions is an experienced team specializing in international digital transformation projects within the fintech sector. We are actively expanding into Southeast Asia and are committed to contributing to Vietnam’s ongoing digital financial evolution.

RunRule’s ecosystem includes a lending system, debt management, decision support, campaign manager, etc. At the heart of our offering is the 2RS Platform — a solution designed to simplify and accelerate application development.

The 2RS Platform empowers organisations to rapidly build and deploy custom automation solutions with minimal IT dependency. By offering full-stack development capabilities and intuitive low-code tools in one seamless environment, we help accelerate innovation and operational efficiency across the financial sector.